Maximize Your Revenue with Accounts Receivable Outsourcing

Accounts Receivable services from First Credit Services.

Accounts Receivable by First Credit Services

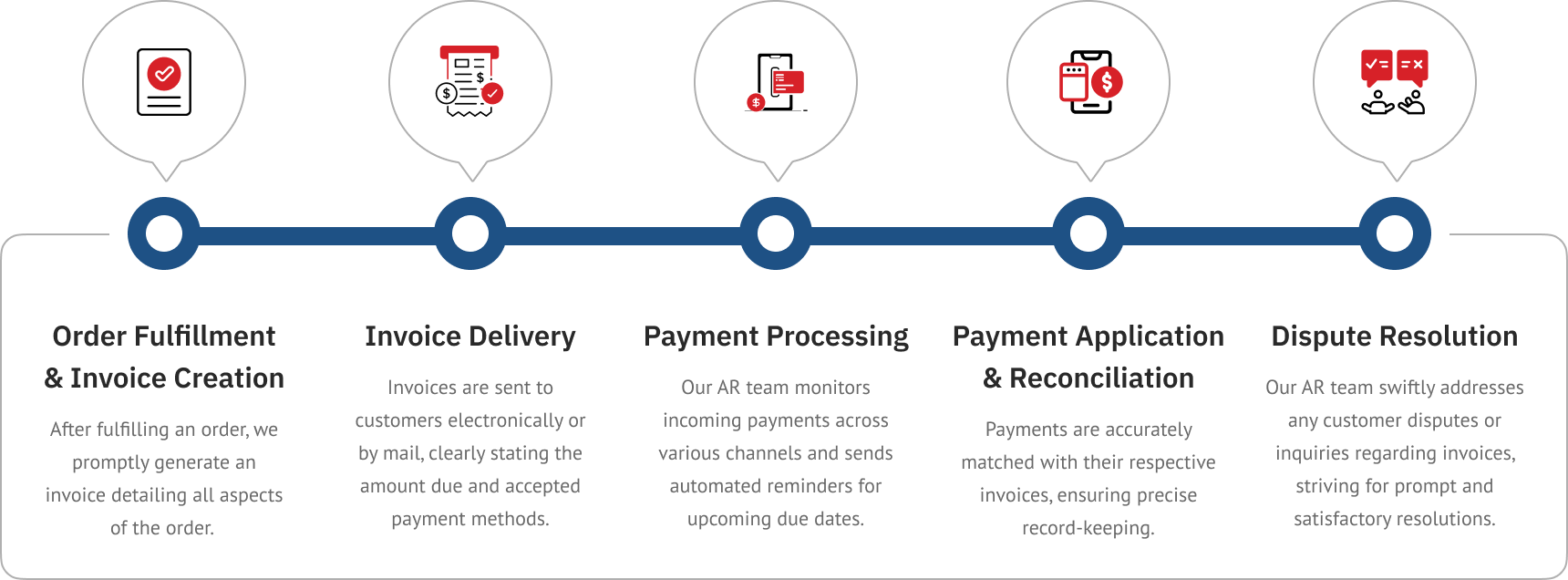

Accounts Receivable Workflow at First Credit Services

Why Outsource Your Accounts Payable?

Cost Savings

Efficiency and Productivity

Industry Expertise

Scalability and Flexibility

Risk Mitigation

OUR INSIGHTS

The Latest From First Credit Services

Customer Service Outsourcing

21 June 2023Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Failed Payment Management

21 June 2023Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Cancellation Management- Save More Members and Improve the Environment of Your Club

23 June 2022Our client operates a chain of high-volume health clubs. They saw the amount of time their managers and front desk...

Get in touch

Interested to know more? We can help.

Frequently Asked Questions

Why are businesses increasingly choosing to outsource accounts receivable?

Businesses turn to accounts receivable outsourcing to reduce costs, speed up collections, and access specialized expertise. By outsourcing, companies improve efficiency, lower Days Sales Outstanding (DSO), and allow internal teams to focus on strategy instead of routine follow-ups.This approach makes debt recovery more consistent and customer-friendly.

How is AI transforming BPO?

How does outsourcing improve cash flow visibility and predictability?

Accounts receivable outsourcing gives businesses real-time tracking of receivables and payment cycles. By accelerating collections and reducing delays, outsourcing improves cash flow predictability. With accurate reporting and analytics, companies can forecast inflows better, strengthen liquidity, and make informed financial decisions to support growth and stability.

How does outsourcing improve financial planning?

Outsourcing improves financial planning by reducing uncertainty in cash inflows. With faster invoicing, consistent collections, and detailed AR reporting, businesses gain clearer insights into revenue timing. This allows leaders to allocate budgets more effectively, plan investments confidently, and maintain stronger vendor and customer relationships in the long term.Many businesses also save time by getting work done faster and more accurately. Over time, this leads to better cost control without lowering service quality.